23 Personal Finance Books That Will Change How You Manage Money

Insights from Tony Robbins, Farnoosh Torabi, Lynnette Khalfani-Cox, and 20 more experts reveal these top Personal Finance Books

What if the financial advice you've been hearing isn't the full story? Personal finance isn't just about saving pennies or cutting lattes; it's a mindset, a set of strategies, and, above all, a tool for creating freedom. In a world where money often feels complicated or out of reach, these 23 books offer clear, relatable lessons to help you take control now.

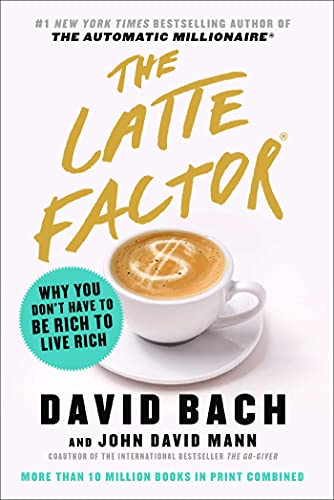

Experts like Tony Robbins, who champions practical wealth-building techniques, and Farnoosh Torabi, a trusted financial podcast host, have found these titles essential. For instance, Robbins points to David Bach's The Latte Factor as a game-changer for overcoming money fears, while Torabi lauds Tiffany Aliche's Get Good with Money for its empathetic, actionable guidance. Their endorsements underscore the value of these works across diverse financial journeys.

While these expert-curated books provide proven frameworks, readers seeking content tailored to their specific income, debt levels, or investment goals might consider creating a personalized Personal Finance book that builds on these insights. This approach can sharpen your path to financial confidence and independence with strategies designed just for you.

Recommended by Tyler Code Wildcat

Gamer and content creator

“@CouRageJD my favorite finance self improvement book is Rich Dad Poor Dad. If you're at all interested in learning more about personal finance that's a great place to start.” (from X)

by Robert T. Kiyosaki··You?

Robert Kiyosaki's decades as an investor and educator shaped this book into a challenge against traditional financial advice like "get a good job" and "save money." You learn to distinguish assets from liabilities, rethink the value of your home, and understand why financial education isn't covered in schools. For instance, he explains how "working for money" differs drastically from "having your money work for you," a mindset shift that underpins the book's lessons. This book suits anyone wanting to transform their approach to money, particularly those skeptical of conventional wisdom or seeking foundational financial insight.

Recommended by Lynnette Khalfani-Cox

Money coach, bestselling author

“Get Good with Money helps you put all the pieces of your financial life together without making you feel overwhelmed or ashamed about your circumstances. Whether you need to budget better, slash debt, and save more money or learn to invest, boost your net worth, and build wealth, Tiffany Aliche offers great advice to let you know you can do this, sis!”

by Tiffany the Budgetnista Aliche··You?

by Tiffany the Budgetnista Aliche··You?

Drawing from her experience as a financial educator who has empowered over a million women, Tiffany Aliche lays out a ten-step framework in this book that balances practical budgeting, debt management, and investing with the emotional aspects of money. You learn to assess whether your challenges stem from income or spending, create a "noodle budget" tailored to your goals, and handle credit scores, insurance, and heirs with clear, actionable clarity. Chapters like the toolkit for automating bills and the assessments for savings priorities offer concrete ways to stabilize your financial footing. If you want straightforward guidance grounded in real-life financial recovery and growth, this book will meet you where you are and move you forward without judgment.

by TailoredRead AI·

by TailoredRead AI·

This tailored book explores personal finance essentials and wealth-building strategies designed specifically for your background and goals. It covers foundational topics like budgeting, saving, and investing, while delving into nuanced areas such as debt management, retirement planning, and wealth preservation. By focusing on your unique financial situation and interests, it reveals practical ways to grow and protect your wealth over time. Structured to provide clear explanations and actionable knowledge, this personalized guide matches expert insights with your personal learning needs, enabling you to develop confident money skills that support lasting financial security.

Recommended by Lynnette Khalfani-Cox

The Money Coach, NYT Bestselling Author

“The Black Girl's Guide to Financial Freedom is a great roadmap to mastering your money - and learning a lot about yourself in the process. With practical advice and a solid dose of big sister wisdom, Paris Woods shows you how to check your financial assumptions, reframe unhealthy attitudes about money, and figure out the best path for your unique financial journey.”

by Paris Woods··You?

Paris Woods challenges the conventional wisdom that wealth-building requires traditional career shifts or complex investment strategies. Drawing on her background as an education leader and IRS-certified tax preparer, she offers a relatable, straightforward guide tailored especially for Black women aiming to achieve financial independence on their own terms. Through chapters on earning degrees debt-free and avoiding common financial traps, you gain practical tools to design a fulfilling, financially free life. This book suits those tired of generic advice, looking instead for a clear, personalized path to retire early and build lasting wealth.

Recommended by Kenny Accent Investing

Finance educator and wealth strategist

“Powerful lessons from the book Rich Dad, Poor Dad that will make your finances better than 99% of people:” (from X)

by Robert T. Kiyosaki··You?

by Robert T. Kiyosaki··You?

Unlike most personal finance books that focus on budgeting and saving, Robert T. Kiyosaki challenges the common approach by revealing how you can work less and still increase your earnings through smart financial strategies. Drawing from his own journey as an entrepreneur and investor, he explains the four quadrants of income generation and how shifting from employee to business owner or investor can transform your financial future. You’ll gain insights into tax advantages, passive income streams, and mindset shifts that many traditional education systems overlook. The book suits anyone ready to rethink money and take control beyond the usual paycheck-to-paycheck cycle.

by Erin Skye Kelly··You?

Erin Skye Kelly challenges the conventional advice often handed down by financial institutions by sharing her personal journey out of consumer debt and the practical methods she developed along the way. You’ll learn a three-phase approach that focuses not just on numbers but on shifting your mindset about money, emphasizing repetition and personal growth to sustain financial freedom. The book walks you through overcoming debt regardless of its size, making it accessible for anyone feeling overwhelmed or skeptical about traditional finance books. Chapters detail how to dismantle debt traps and cultivate habits that lead to lasting abundance, making it particularly suited for those tired of jargon-heavy guides and looking for an empathetic, straightforward path.

by TailoredRead AI·

This tailored book explores a step-by-step plan to revamp your budgeting and debt management swiftly, focusing on your unique financial situation and goals. It reveals practical techniques to build effective money habits, reduce debt, and maintain balanced budgets, all tailored to match your background and interests. By synthesizing expert knowledge with your personal needs, it guides you through a focused 30-day reset that makes complex financial concepts approachable and actionable. The book emphasizes gradual habit change and clear budgeting methods that you can apply immediately, helping you take control of your finances with confidence and clarity.

Recommended by Justin Baldoni

Actor and director, personal growth advocate

“This should be required reading in high school and college! This book has an answer to every question a beginner has ever wondered about money, and how to use it to make a better life and world.”

by Tori Dunlap··You?

When Tori Dunlap first dug into the financial landscape, she uncovered how deeply gender biases skew money education and opportunities. This book unpacks those disparities with a candid, no-nonsense tone, teaching you to navigate debt, investing, and negotiation through a feminist lens. You’ll find practical tools like journaling prompts to assess your money mindset and concrete steps to set and meet investment goals. It’s especially useful if you want to understand the social forces shaping your finances and learn how to reclaim control without sacrificing your values.

Recommended by Angela Yee

Radio host and media entrepreneur

“The lessons that Cedric teaches about creating wealth should be required reading in school. I didn't develop a millionaire mindset until my thirties, but having this mentorship and learning these actionable steps would have accelerated my road to prosperity. So many of us don't have the startup capital or access to funds, but where you start doesn't have to be where you finish!”

by Cedric Nash··You?

Drawing from his extensive experience as a successful investor and CEO, Cedric Nash crafted this book to address the persistent racial wealth gap with a hands-on approach to building real wealth. You learn how to shift your mindset, adopt core values, and execute a wealth-building system that covers earning more, investing in securities, real estate, entrepreneurship, and alternative assets. Nash’s M$M system is presented through candid stories and humor, making complex financial strategies accessible and relatable. This book suits anyone determined to build lasting wealth despite starting with limited resources or facing systemic barriers.

Recommended by Fiona The Millennial Money Woman

Financial strategist and millionaire mentor

“@DecadeInvestor Index funds are one of the best way to build wealth over the long term. Great book and great read!” (from X)

by Jl Collins, MR Money Mustache··You?

by Jl Collins, MR Money Mustache··You?

J L Collins turns what could be an overwhelming topic—investing and money management—into a straightforward, approachable guide rooted in personal experience. Originally a series of letters to his daughter, the book teaches you how to avoid debt, understand the stock market's true nature, and wisely allocate assets through different life phases. Specific chapters break down complex concepts like the 4% withdrawal rule and the pros and cons of various retirement accounts, giving you clear frameworks to build and preserve wealth. This book suits anyone eager to demystify investing, especially those who want lasting financial independence without getting bogged down in jargon.

Recommended by Joe Sanberg

Entrepreneur; Co-Founder @Aspiration

“I am so proud of my fiancée Nicole Lapin who just received great news that her new book, Miss Independent, is #2 on the Wall Street Journal Best Seller list. Nicole is authentically passionate about and dedicated to empowering all women through understandable financial advice!” (from X)

by Nicole Lapin··You?

Unlike most personal finance books that lean heavily on jargon, Nicole Lapin brings a fresh, approachable voice to investing with "Miss Independent." Drawing on her extensive experience as a financial journalist and TV anchor, she breaks down complex concepts like stocks, bonds, and REITs into understandable terms, making investing accessible to those without prior knowledge. The book offers practical insights on automating savings, understanding compound interest, and making savvy financial decisions, including mortgages and life insurance. If you’re aiming to take control of your money confidently and build real wealth without needing a hefty starting capital, this book lays out a straightforward 12-step plan that demystifies the path to financial independence.

Recommended by New York Magazine

“A cheerful manifesto on removing obstacles between yourself and the income of your dreams.”

by Jen Sincero··You?

While working as a success coach, Jen Sincero noticed that financial blocks often stemmed from mindset issues rather than lack of knowledge. She shares her personal journey from financial struggle to wealth, blending humorous essays with straightforward exercises that challenge your beliefs about money. You’ll learn to identify and overcome limiting thoughts, reshape your relationship with wealth, and tap into your potential to generate income. Chapters like "Shake Up the Cocktail of Creation" and "Stop Playing Victim to Circumstance" offer concrete mindset shifts that anyone can apply. This book suits you if you’re ready to rethink money on a deeper level and take control of your financial story.

by Ramit Sethi··You?

While working as a personal finance writer and entrepreneur, Ramit Sethi noticed most money advice was either too rigid or complicated. In response, he crafted a 6-week program that teaches you how to automate your finances, crush debt, and negotiate raises with straightforward language and practical scripts. You’ll learn how to pick the right bank accounts, invest without stress, and spend guilt-free on what matters to you. The book also tackles big life expenses like weddings and homes, making it useful for anyone ready to take control of their money without sacrificing lifestyle.

by Naseema McElroy··You?

by Naseema McElroy··You?

Naseema McElroy brings a personal and practical perspective to personal finance, drawing from her own journey of paying off nearly $1 million in debt and building significant wealth. In this book, you learn how to assess your current financial situation, manage debt effectively, and make informed decisions about budgeting, banking, and investing. For example, she outlines seven methods to tackle debt and offers five credit card commandments that challenge common spending habits. This book is particularly suited for those feeling overwhelmed by finances who want a clear, straightforward roadmap to financial stability without jargon or complexity.

Recommended by James O'Shaughnessy

Founder and Chairman, OSAM LLC

“Nick has a genuine gift - while he uses rigorous empirical evidence to make his case, he also manages to tell the story in such a way to keep the reader's attention and give them practical, actionable advice. In addition, he has just enough of a mischievous streak to challenge some long-held assumptions about investing, but in a manner that makes the empirical data a fresh, interesting story. Investors, new and old, will benefit from Nick's practical approach to investing.”

by Nick Maggiulli··You?

by Nick Maggiulli··You?

When Nick Maggiulli, a data scientist and COO at Ritholtz Wealth Management, applies his analytical rigor to personal finance, the result is a book that questions many common money myths. In "Just Keep Buying," you learn why trying to time the market often backfires, why saving less than you think can still lead to financial security, and how to navigate market downturns with confidence. The book’s chapters dissect big financial questions with data-backed clarity, making it ideal for anyone looking to build wealth grounded in evidence rather than guesswork. If you want a grounded approach to saving and investing that cuts through the noise, this book is for you.

Recommended by Tony Robbins

Business and life coach, author

“David Bach is the one financial expert to listen to when you’re intimidated by your finances. His powerful and easy-to-use program will show you how to spend, save and invest your money to afford your dreams.”

by David Bach, John David Mann··You?

by David Bach, John David Mann··You?

When David Bach discovered that everyday spending habits can quietly erode financial potential, he crafted a simple yet powerful narrative to expose this truth. Through the story of Zoey and Henry, you learn to identify those small, habitual expenses—like your daily latte—that cumulatively undermine wealth building. The book breaks down three secrets to financial freedom, emphasizing that anyone can redirect their existing income toward dreams without drastic lifestyle changes. This approach benefits young professionals and anyone overwhelmed by finances, offering a relatable path to recognize hidden savings and build lasting wealth.

Recommended by Farnoosh Torabi

Financial expert, author, podcast host

“An essential guide to financial well-being for women of all ages. Bola's book expertly demystifies handling your money, getting out of debt and creating a sound financial future for yourself.”

by Bola Sokunbi··You?

Unlike most personal finance books that often speak in broad terms, Bola Sokunbi draws directly from her own financial missteps to guide you through managing debt, budgeting on modest incomes, and investing for the future. You’ll find detailed chapters on cleaning up credit card chaos and starting side hustles, all framed within a supportive narrative aimed at empowering women. The book also shares relatable stories from other women navigating financial challenges, making the advice feel accessible and realistic. If you want practical confidence to take charge of your money and build lasting wealth, this book equips you with both mindset and method, though it’s especially tuned to female readers ready to change their relationship with money.

Recommended by Grant Sabatier

Author of Financial Freedom, Millennial Money

“Quit Like A Millionaire is about so much more than making money, traveling the world, and retiring early (although it teaches you how to do all three insanely well!). It’s a new roadmap to living an awesome life! You don't need to settle for status quo. Life's too short for that; so don't. This book will both inspire and entertain you, while actually giving you the steps and mindset to become a millionaire. Retiring early isn't easy, but it's never been easier in history to make it happen. There’s no fluff here. This is the real deal.”

by Kristy Shen, Bryce Leung, JL Collins··You?

by Kristy Shen, Bryce Leung, JL Collins··You?

Kristy Shen and Bryce Leung challenge the conventional wisdom that early retirement requires extraordinary luck or high-risk ventures. Drawing from Kristy's journey from growing up in poverty to retiring at 31 with a million dollars, they provide a math-based approach to financial independence that emphasizes controlling expenses without sacrificing quality of life. You’ll learn how to build a resilient investment portfolio, apply the 4 percent rule, and use the Yield Shield to protect your wealth during downturns. This book suits anyone serious about retiring early or gaining solid control over their finances through proven, straightforward strategies.

Recommended by James Altucher

Founder & CEO, Reset Inc

“I really believe in this philosophy. You should read it and see all the different methods and philosophies and ways to figure this out in your own life.”

by Bill Perkins··You?

by Bill Perkins··You?

Called the “Last Cowboy” of hedge funds by the Wall Street Journal, Bill Perkins draws on his decades managing billions in energy trading to challenge conventional money-saving wisdom. He argues that accumulating wealth at the expense of living fully is a missed opportunity, illustrating his points with concepts like "experience bucketing" and the "net worth curve." You’ll learn how to balance spending and saving to maximize memorable life experiences across different stages, supported by behavioral finance insights and real-life stories. This book speaks to anyone frustrated by traditional financial advice and eager to rethink how money serves life’s moments rather than simply extending wealth.

Recommended by Nicholas Clements

Cofounder of MagnifyMoney.com

“Thinking about money, especially when you don’t have much, can be painful. But Erin Lowry shows that you don’t need to be a mathematical genius to get on the right track.”

Erin Lowry challenges the conventional wisdom that personal finance must be intimidating or dull, especially for millennials juggling student loans, social pressures, and early career challenges. This book goes beyond basic budgeting and credit card advice, diving into the emotional and social dynamics of money—like navigating splitting bills with friends or discussing debt with partners. You’ll find chapters that unpack your psychological relationship with money and practical guidance for managing financial stress without panic. If you’re in your 20s or 30s trying to get a grip on your finances without feeling overwhelmed, this book speaks your language with humor and straightforwardness.

Recommended by Paula Pant

Host of Afford Anything podcast

“[Rachel's] words about money sound like text messages from your funniest friend. Read this book. Send a copy to your BFF. Learn how to get your financial $hit together.”

by Rachel Richards, Paula Pant··You?

by Rachel Richards, Paula Pant··You?

Rachel Richards, a former financial advisor who retired in her twenties by living off substantial passive income, uses her firsthand experience to cut through the noise of personal finance. This book offers a refreshingly direct guide to mastering fundamental money skills like budgeting, debt reduction, and investing, all framed within her straightforward 7-step process and the 4-Bucket Savings Strategy. You’ll learn how to double your income, improve your credit score, open a brokerage account, and allocate money effectively across savings and retirement accounts. If you’re someone starting from scratch or struggling with financial basics, this no-frills approach will give you clarity without jargon or fluff.

Recommended by The Washington Post

“I’m recommending a book that will give you a crash course in budgeting basics … Budgeting 101 by Michele Cagan, a certified public accountant. In her book, Cagan covers a lot in short, easy-to-follow sections. All the information is there to show you how to track expenses, save, get out of debt and set goals to do the things you really want. Cagan makes the case that a budget isn’t a buzz killer. It’s financial salvation.”

by Michele Cagan CPA··You?

Michele Cagan, a seasoned CPA with over two decades of financial expertise, crafted this guide to demystify budgeting and make it approachable for everyday life. The book breaks down how to track expenses, reduce debt, set achievable financial goals, and build savings through manageable steps. You’ll find practical chapters on transforming a budget from a dreaded chore into a tool for financial stability, such as strategies for handling unexpected costs and prioritizing spending. If you're looking to take control of your money without jargon or fluff, this book offers straightforward guidance that benefits anyone aiming to improve day-to-day money management.

Recommended by Rosabeth Moss Kanter

Harvard Business School professor, author

“A practical tour de force from the maven of money. This is simply the best handbook for managing personal finances that I have ever seen. It belongs on every bookshelf — or best yet, on every desk near every checkbook or computer.”

by Jane Bryant Quinn··You?

by Jane Bryant Quinn··You?

Drawing from decades as a leading personal finance commentator, Jane Bryant Quinn addresses the critical challenge of making retirement savings last through longevity and market uncertainty. You’ll learn how to optimize income streams from Social Security, pensions, home equity, and investment withdrawals, balancing safety with growth to stretch your money over many years. The book includes practical insights like evaluating lump sum versus monthly pension options and the strategic use of lifetime annuities. If you’re navigating retirement planning with concerns about outliving your resources, this book offers clear guidance without jargon, though those early in their financial journey might find it more relevant later on.

Recommended by Karen Hunter

Pulitzer Prize-winning journalist and publisher

“I like The Automatic Millionaire and Smart Women Finish Rich by David Bach. These books provide foundational financial knowledge essential for anyone building their money skills.” (from X)

by David Bach··You?

David Bach's decades of experience as a financial advisor and bestselling author led him to craft a system that strips away the complexity often associated with personal finance. In this expanded edition, you’ll discover how automating your savings and investments can build wealth steadily without the need for strict budgeting or discipline. The book walks you through practical setups like automatic bill pay and investment contributions, making financial security accessible even if you struggle with money management. Chapters on tax strategies and leveraging technology reflect the updated landscape, providing tools relevant for today’s financial environment. This approach resonates particularly well if you want to simplify your financial life and focus on long-term growth without constant oversight.

Recommended by Vicki Robin

New York Times Bestselling Author

“When your financial planner sternly says you need a budget, it’s like a door slamming shut on a happy future. When Jesse Mecham says it, it’s like a door swinging open to a free life. He understands how financial stress feels. His principles and tools come right out of his own life experience, but also from his CPA training. His system is psychologically and financially sound. You’re going to love this book.”

by Jesse Mecham··You?

Jesse Mecham, drawing from his background as a CPA and personal experience managing finances with his wife, developed a budgeting approach that reshapes how you handle money. In this book, you learn four distinct rules that turn budgeting from a chore into a flexible tool, such as breaking down larger expenses into manageable monthly amounts and aging your money to escape the paycheck-to-paycheck trap. The chapters guide you through practical steps like giving every dollar a job and adjusting your budget as life changes, tailored to all income levels and family setups. If you want to gain control over your finances without feeling restricted, this book offers a clear, psychologically sound system that suits both beginners and those struggling with debt.

Get Your Personal Finance Plan in 10 Minutes ✨

Stop guessing—get money strategies tailored to your needs without reading dozens of books.

Trusted by thousands of Personal Finance enthusiasts and experts

Conclusion

This collection of 23 books showcases a mosaic of approaches to personal finance—from mindset shifts and debt management to investment and retirement planning. If you're facing overwhelming debt, Get the Hell Out of Debt offers a compassionate yet effective roadmap. For those eager to automate and simplify, The Automatic Millionaire and I Will Teach You to Be Rich deliver actionable systems. Millennials juggling social and financial pressures will find Broke Millennial speaks their language with humor and honesty.

For rapid results, pairing Quit Like a Millionaire with The Simple Path to Wealth can accelerate your journey toward early retirement and financial independence. Meanwhile, women seeking empowerment will find allies in Financial Feminist and Clever Girl Finance, which blend practical advice with cultural insight.

Alternatively, you can create a personalized Personal Finance book to bridge the gap between general principles and your specific situation. These books can help you accelerate your learning journey, turning complex money matters into manageable, empowering steps.

Frequently Asked Questions

I'm overwhelmed by choice – which book should I start with?

Start with Rich Dad Poor Dad if you want to shift your mindset about money fundamentals. If you prefer practical steps, Get Good with Money breaks down budgeting and debt in a clear way. Both have been praised by respected experts for making personal finance approachable.

Are these books too advanced for someone new to Personal Finance?

Not at all. Several books, like Miss Independent and Broke Millennial, are designed specifically for beginners, using accessible language and practical examples. They help build confidence while covering essential topics without jargon.

What’s the best order to read these books?

Consider starting with mindset and basics—Rich Dad Poor Dad or Financial Feminist—then move to budgeting and debt management like Get the Hell Out of Debt or You Need a Budget. Follow with investing and wealth-building titles such as The Simple Path to Wealth and Just Keep Buying.

Should I start with the newest book or a classic?

Both offer value. Classics like Rich Dad Poor Dad have stood the test of time with foundational lessons, while newer titles such as Financial Feminist address current social dynamics. Combining both perspectives gives a well-rounded understanding.

Do these books assume I already have experience in Personal Finance?

Many, including I Will Teach You to Be Rich and Quit Like a Millionaire, are crafted for readers at all levels. They guide you from basics to advanced strategies, making them useful whether you’re just starting or looking to deepen your knowledge.

Can I get personalized advice tailored to my situation?

Yes! While these expert books offer broad, proven strategies, creating a personalized Personal Finance book can tailor insights to your income, debt, goals, and experience. This complements expert knowledge with specific, actionable plans. Learn more here.

📚 Love this book list?

Help fellow book lovers discover great books, share this curated list with others!

Related Articles You May Like

Explore more curated book recommendations