7 Algotrading Books That Separate Experts from Amateurs

Douglas Kass, Barry Ritholtz, and Brian Sullivan recommend these key Algotrading Books to accelerate your trading skills

What if the secret to mastering financial markets lies not in gut instinct but in code? Algorithmic trading, or algotrading, has transformed investing by harnessing data, math, and automation to execute trades faster and smarter. With markets evolving rapidly, understanding algotrading is no longer optional for serious investors and traders.

Douglas Kass, a seasoned market strategist, and Barry Ritholtz, director at Ritholtz Wealth Management, both praise The Man Who Solved the Market for its vivid account of quantitative trading's origins. Meanwhile, Brian Sullivan of CNBC highlights how these books demystify complex strategies, making them accessible. Their journeys reveal how algorithmic trading blends technology with human insight.

While these expert-curated books provide proven frameworks, readers seeking content tailored to their experience level, trading goals, and preferred markets might consider creating a personalized Algotrading book that builds on these insights for a sharper edge.

Recommended by Douglas Kass

Investor and market strategist

“Great book and Z man is a great journalist.” (from X)

by Gregory Zuckerman··You?

by Gregory Zuckerman··You?

What happens when investigative financial journalism meets the rise of algorithmic trading? Gregory Zuckerman, an acclaimed Wall Street Journal reporter with three Gerald Loeb Awards, explores this intersection by profiling Jim Simons, a mathematician who fundamentally reshaped markets through data-driven strategies. You’ll gain insight into the intricate workings of Renaissance Technologies’ Medallion fund, understanding how mathematical models and computational power generated unprecedented returns. The book delves into Simons’ journey from decoding to dominating financial markets, providing context on the broader impact of quant trading on finance and politics. This narrative suits anyone keen on the human and technical forces behind quantitative trading’s success and its far-reaching repercussions.

by Kevin J. Davey··You?

Unlike most trading books that focus on theory alone, Kevin J. Davey offers a hands-on guide grounded in his own experience winning three consecutive World Cup Championships of Futures Trading®. You learn how to mine market data for statistical patterns, design entry and exit rules, and rigorously test systems using historical data and Monte Carlo simulations. The book walks you through adapting to evolving market conditions, including when to scale allocations or abandon failing systems. If you want to build algorithmic trading strategies with practical tools and real-world validation, this book gives you a clear path to follow, especially useful if you trade futures or want to automate your approach.

by TailoredRead AI·

This personalized book on algotrading mastery explores a comprehensive range of algorithmic trading strategies tailored precisely to your interests and experience level. It reveals how to navigate the complexities of financial markets using data-driven techniques, blending quantitative analysis with practical trading insights. By focusing on your specific goals, it examines strategy development, risk management, and market adaptation to empower you with a clear, customized path through the sophisticated world of algorithmic trading. This tailored approach ensures you engage deeply with content that matches your background and trading ambitions, making advanced concepts accessible and relevant.

Recommended by Tone Vays Thefinancialsummit.com

Derivatives trader, analyst, crypto host

“Amazing words of trading wisdom from J. Welles Wilder Jr. as published in his 1978 book "New Concepts in Technical Trading Systems" [father of RSI, ADX, SAR & More]” (from X)

by J. Welles Wilder··You?

by J. Welles Wilder··You?

J. Welles Wilder's decades as a trader and analyst culminated in this book, where he unveils technical trading systems that changed market analysis. You gain insights into his pioneering indicators like the RSI, ADX, and SAR, learning how they capture momentum, volatility, and trend strength. The book meticulously explains the calculation and application of these tools, enabling you to refine your trading strategies with quantifiable metrics. It suits traders and analysts aiming to deepen their technical toolkit and understand market dynamics beyond surface-level charts. Specific chapters break down each indicator's role, making complex concepts accessible for those serious about technical trading.

by Perry J. Kaufman··You?

by Perry J. Kaufman··You?

What makes this book different is Perry J. Kaufman's blend of decades-long trading experience with a practical mindset focused on building algo systems tailored to your unique style. You learn not just theory but how to recognize patterns like seasonal trends, volatility shifts, and interest rate impacts, then translate those into actionable trading strategies. Kaufman guides you through developing trader insight by emphasizing trading itself as a teacher, helping you adapt and refine your system based on real market feedback. This book suits anyone serious about creating an algorithmic trading approach grounded in both data and intuition, especially those ready to engage actively with their trades rather than rely solely on backtesting.

by Kevin J Davey··You?

Kevin J. Davey draws from nearly three decades of trading experience and engineering precision to demystify algorithmic trading for retail investors. You’ll explore not just how to start building your own trading algorithms, but also how to choose the right platform and grasp the pros and cons of algo trading. The book walks you through developing simple strategies, offering practical insights like Davey’s approach to testing and refining systems, especially useful for traders aiming to compete with professionals. If you want a straightforward introduction that balances technical basics with real-world trading mindset, this book fits, though seasoned quants may find its scope introductory rather than exhaustive.

by TailoredRead AI·

This tailored book explores a step-by-step plan to swiftly develop and deploy algorithmic trading systems, designed specifically to match your background and goals. It covers essential concepts from strategy design to backtesting and live deployment, focusing on the technical and practical aspects critical to rapid progress. You’ll gain a personalized pathway through the complexities of trading algorithms, ensuring the content aligns with your interests in markets, coding, and risk management. By offering a tailored approach, this book helps you navigate the essential phases of algorithmic trading development with clarity and focus, turning expert knowledge into actionable learning that fits your pace and experience. It reveals how to build, test, and refine trading bots effectively, accelerating your journey from idea to implementation.

by Jun Chen, Edward P K Tsang··You?

by Jun Chen, Edward P K Tsang··You?

Jun Chen and Edward P K Tsang bring deep academic insight to financial market analysis in this book, exploring a novel approach called Directional Change. Instead of traditional time-based sampling, they focus on price movements when market directions shift, allowing you to detect regime changes often missed by standard models. You'll learn how machine learning, particularly Hidden Markov Models, can identify normal versus abnormal market regimes and how this informs algorithmic trading strategies. The book is technical but clear, suited for practitioners and researchers seeking a fresh perspective on market data analysis and trading algorithm design.

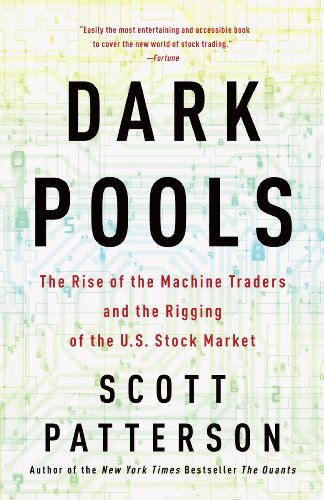

by Scott Patterson··You?

Scott Patterson, a seasoned journalist for The Wall Street Journal, explores the shadowy world of automated trading in Dark Pools. You’ll learn about the evolution of electronic stock markets, from the idealistic vision of programmer Josh Levine to the rise of opaque "dark pools" where high-speed algorithms trade rapidly beyond human oversight. The book unpacks the complex interplay between technology and market fairness, revealing how machine-driven trading reshapes financial landscapes. If you’re intrigued by the mechanics behind modern stock trading and the ethical questions it raises, this book offers a sharp, narrative-driven perspective grounded in actual market events.

Get Your Personal Algotrading Strategy Fast ✨

Stop sifting through generic advice. Get targeted, actionable algotrading tactics in minutes.

Trusted by top algotrading professionals worldwide

Conclusion

Together, these seven books reveal three key themes: the interplay of data and intuition in trading, the importance of rigorous testing and adaptation, and the impact of technological evolution on markets. If you're new to algorithmic trading, start with Kevin J. Davey's Introduction To Algo Trading to build foundational skills. For those ready to design strategies, Perry Kaufman's guide offers actionable steps. Combine these with The Man Who Solved the Market to grasp the bigger picture.

For rapid implementation, pairing Kevin Davey's system-building methods with Jun Chen's advanced regime detection techniques can accelerate your edge. Alternatively, you can create a personalized Algotrading book to bridge the gap between general principles and your specific situation.

These selections can help accelerate your learning journey, equipping you to navigate the complexities of modern markets with confidence and clarity.

Frequently Asked Questions

I'm overwhelmed by choice – which book should I start with?

Start with Kevin J. Davey's Introduction To Algo Trading. It's designed for retail traders and lays a solid foundation in algorithmic trading basics, helping you grasp key concepts before moving on.

Are these books too advanced for someone new to Algotrading?

Not at all. Several titles, like Davey's introductory book, cater to beginners. Others, such as Perry Kaufman's guide, suit more experienced readers ready to develop custom strategies.

What's the best order to read these books?

Begin with foundational books like Introduction To Algo Trading, then progress to practical system-building and strategy development guides. Finish with broader market context books like Dark Pools or The Man Who Solved the Market.

Do these books focus more on theory or practical application?

They offer a balance. For example, Davey and Kaufman provide hands-on strategy development, while The Man Who Solved the Market and Dark Pools deliver narrative and market insights.

Are any of these books outdated given how fast Algotrading changes?

Some classics like Wilder’s New Concepts in Technical Trading Systems remain highly relevant for technical indicators. Meanwhile, newer works like Chen and Tsang’s book introduce cutting-edge machine learning methods.

Can I get targeted Algotrading insights without reading all these books?

Yes! While these books offer valuable frameworks, you can also create a personalized Algotrading book tailored to your experience, goals, and interests for focused, actionable guidance.

📚 Love this book list?

Help fellow book lovers discover great books, share this curated list with others!

Related Articles You May Like

Explore more curated book recommendations