6 Best-Selling Algotrading Books Millions Love

Douglas Kass, Barry Ritholtz, and Brian Sullivan endorse these best-selling Algotrading books packed with expert insights and proven strategies.

There's something special about books that both critics and crowds love, and when it comes to algotrading, these six titles stand out for their impact and expert endorsement. Algorithmic trading continues to reshape financial markets, with millions seeking to understand and harness its power. These books offer proven insights into the strategies, systems, and market dynamics that define modern algo trading, making them invaluable resources for investors and traders alike.

Douglas Kass, a seasoned financial analyst, praises The Man Who Solved the Market for its deep dive into Jim Simons' revolutionary quantitative approach. Meanwhile, Barry Ritholtz, director and CIO of RWM, highlights the compelling storytelling that makes complex trading concepts accessible. Financial journalist Brian Sullivan also recommends this title, emphasizing its relevance for anyone intrigued by the intersection of math and markets.

While these popular books provide proven frameworks and broad perspectives, readers seeking content tailored to their specific algotrading goals might consider creating a personalized Algotrading book that blends these validated approaches with their unique needs and experience levels.

Recommended by Douglas Kass

Financial analyst and commentator

“Great book and Z man is a great journalist.” (from X)

by Gregory Zuckerman··You?

by Gregory Zuckerman··You?

Gregory Zuckerman challenges the conventional wisdom that finance is purely about intuition and luck by detailing Jim Simons' pioneering use of mathematics and algorithms to dominate markets. You’ll learn how Simons, a former code breaker and mathematician, built Renaissance Technologies into a powerhouse using data-driven strategies that yielded staggering returns, as explored through intimate accounts from his team and fund performance. The book benefits anyone curious about the intersection of math, technology, and investing, revealing insights into quantitative trading methods and their broader impact on finance and politics. Chapters highlight specific breakthroughs, such as the Medallion Fund’s secretive algorithms and the cultural shift within hedge funds toward systematic trading.

by Kevin J. Davey··You?

Kevin J. Davey challenges the conventional wisdom that successful trading is purely discretionary by offering a structured method to build algorithmic trading systems. Drawing from his background as an aerospace engineer and his experience winning three World Cup Championships of Futures Trading® with triple-digit returns, he walks you through identifying statistical market patterns, testing strategies with Monte Carlo simulations, and adapting to changing market conditions. The book’s detailed chapters on setting entry and exit rules and managing system allocation provide concrete tools for traders aiming to automate and refine their approach. If you want a grounded, data-driven framework to develop your own trading systems, this book offers clear guidance, though it’s best suited for those ready to engage deeply with quantitative methods.

by TailoredRead AI·

This personalized AI-created book explores battle-tested algorithmic trading methods tailored to your unique experience and objectives. It combines widely validated trading techniques with your specific interests, delivering a focused exploration of algotrading concepts and practices that matter most to you. By addressing your background and goals, the book reveals how popular, reader-validated strategies can be adapted to enhance your trading approach. From foundational principles to nuanced tactic adjustments, it covers essential elements that align with your personal trading style and ambitions, making the learning process engaging and directly applicable. This tailored guide serves as a bridge between collective market knowledge and your distinct trading journey.

by Perry J. Kaufman··You?

by Perry J. Kaufman··You?

During his extensive career in financial markets, Perry J. Kaufman discovered that algorithmic trading isn't just about complex formulas but about aligning your trading system with your own style and insights. This book guides you through crafting a personalized algo trading strategy, starting from identifying your trading personality to recognizing market patterns like seasonal trends and volatility cycles. Kaufman emphasizes learning through actual trading experience, helping you translate theoretical knowledge into profitable decisions. If you're serious about building an algo system tailored to how you operate and want to understand what makes certain strategies sustainable over time, this book delivers a grounded, methodical approach without unnecessary jargon.

by Kevin J Davey··You?

Kevin J. Davey challenges the conventional wisdom that algo trading is only for professionals, offering retail traders a clear path to compete effectively. Drawing from nearly 30 years of trading experience and a background in aerospace engineering and business, Davey walks you through selecting platforms, developing basic strategies, and understanding the pros and cons of algorithmic trading. The book includes practical guidance on launching your own trading algorithms and tips to navigate common pitfalls, making it suitable for those curious about entering the algo trading space. If you want a straightforward introduction without overwhelming jargon, this concise guide covers the essentials you need to get started confidently.

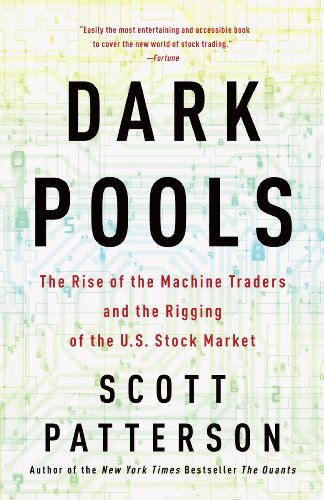

by Scott Patterson··You?

Scott Patterson, a seasoned Wall Street Journal reporter, takes you deep into the shadowy world of electronic trading where algorithms and high-speed machines have reshaped the U.S. stock market. You'll gain insight into the origins and evolution of "dark pools," secretive trading venues that challenge traditional exchanges, and meet key figures like Josh Levine, whose creation aimed to democratize trading but led to unintended market complexities. The book unpacks how AI-driven bots now dominate trades in milliseconds, often beyond human predictability, revealing both technological marvels and market vulnerabilities. If you want a clearer picture of how automated trading influences market fairness and what that means for investors, this narrative offers a revealing perspective.

by TailoredRead AI·

This personalized AI-created book on algotrading offers a unique learning experience tailored to your background and goals. It explores a step-by-step plan designed to accelerate your understanding and application of algorithmic trading techniques within 30 days. The book combines foundational concepts with focused insights that match your interests, allowing you to build effective algotrading skills rapidly. It covers essential topics such as strategy development, risk management, and platform selection, ensuring you gain practical knowledge relevant to your trading aspirations. By addressing your specific objectives, this tailored guide helps you navigate complex markets with confidence and clarity.

by Jun Chen, Edward P K Tsang··You?

by Jun Chen, Edward P K Tsang··You?

What happens when deep computational finance expertise meets fresh data science methods? Jun Chen and Edward P K Tsang bring together their extensive academic and research backgrounds to explore regime change detection through a novel lens called Directional Change. This approach reframes financial data sampling by focusing on price direction shifts rather than fixed intervals, allowing you to glean insights hidden from traditional time series analysis. You'll learn how machine learning models like Hidden Markov Models identify market regimes and how these insights translate into practical algorithmic trading strategies. If you work with financial data, algorithmic systems, or want a fresh perspective on market dynamics, this book offers precise, research-based tools without fluff.

Popular Strategies That Fit Your Situation ✨

Get proven popular methods without following generic advice that doesn't fit.

Validated by expert endorsements and thousands of algotrading enthusiasts

Conclusion

These six algotrading books collectively offer a rich tapestry of proven strategies, from the mathematical genius behind Renaissance Technologies to practical guides for building your own trading systems. If you prefer structured, data-driven methods, Building Winning Algorithmic Trading Systems and Introduction To Algo Trading provide solid foundations. For those looking to grasp market mechanics and the impact of automation, Dark Pools and Detecting Regime Change in Computational Finance reveal critical insights.

Pairing The Man Who Solved the Market with A Guide to Creating A Successful Algorithmic Trading Strategy offers a blend of visionary biography and personalized strategy development, ideal for serious traders. Alternatively, you can create a personalized Algotrading book to combine these proven methods with your unique challenges and goals.

These widely-adopted approaches have helped many readers succeed in algorithmic trading, providing both inspiration and actionable knowledge to navigate increasingly complex financial markets.

Frequently Asked Questions

I'm overwhelmed by choice – which book should I start with?

Start with Introduction To Algo Trading if you're new, as it offers a clear path for retail traders. If you want to understand the quant revolution's roots, The Man Who Solved the Market is a compelling pick.

Are these books too advanced for someone new to algotrading?

Not at all. Introduction To Algo Trading and A Guide to Creating A Successful Algorithmic Trading Strategy are designed with beginners in mind, while others offer deeper dives for more experienced readers.

Do these books focus more on theory or practical application?

It varies. Building Winning Algorithmic Trading Systems leans toward practical system development, while Dark Pools provides context on market structure. Together, they balance theory and practice.

Are any of these books outdated given how fast algotrading changes?

Though markets evolve, foundational concepts in these books remain relevant. For cutting-edge techniques, Detecting Regime Change in Computational Finance covers recent advances in machine learning.

Can I skip around or do I need to read these books cover to cover?

You can read selectively. Many of these books stand alone, so focus on chapters or titles that address your immediate interests or skill level.

How can I get algotrading insights tailored to my specific needs?

Great question! While these expert books offer valuable knowledge, creating a personalized Algotrading book lets you combine proven strategies with your unique background and goals. Check out personalized Algotrading books for tailored guidance.

📚 Love this book list?

Help fellow book lovers discover great books, share this curated list with others!

Related Articles You May Like

Explore more curated book recommendations