20 Wealth Books That Experts Like Tony Robbins Rely On

Curated by Tony Robbins, Daymond John, Tyler Code Wildcat and 7 more experts, these Wealth books offer proven strategies for financial success

What if the secret to building lasting wealth was less about luck and more about mindset and strategy? Wealth isn't just about numbers in a bank account; it's about the stories you tell yourself about money and the habits you build. Right now, as economic landscapes shift and opportunities evolve, mastering wealth has never been more urgent or accessible.

Consider Tony Robbins, whose work coaching millions has shown him that financial freedom starts with changing your relationship to money. Daymond John, founder of FUBU and Shark Tank investor, credits books like Rich Dad Poor Dad for shaping his entrepreneurial mindset. Meanwhile, Tyler Code Wildcat, a video game entrepreneur, found foundational financial lessons in these pages that helped him level up his wealth game.

These 20 Wealth books come highly recommended by experts who have walked the path and helped countless others navigate it. While they offer proven frameworks, you might find even greater value in creating a personalized Wealth book tailored to your unique financial background, goals, and interests to accelerate your journey effectively.

Recommended by Tyler Code Wildcat

Video game personality and entrepreneur

“@CouRageJD my favorite finance self improvement book is Rich Dad Poor Dad. If you're at all interested in learning more about personal finance that's a great place to start. Also Clifford and the Big Red Dog is dope if you like dogs that are big and red.” (from X)

by Robert T. Kiyosaki··You?

Drawing from his personal journey of financial discovery and entrepreneurship, Robert Kiyosaki challenges the conventional wisdom about money in this influential book. You learn to distinguish between assets and liabilities, understand why relying solely on a paycheck limits wealth growth, and why traditional schooling often neglects financial education. For example, the book explores why owning a home isn’t necessarily an asset and introduces the mindset shift needed to have your money work for you, not the other way around. This book benefits anyone looking to rethink their approach to money, whether you’re starting out or reassessing your financial strategy.

by George S Clason··You?

by George S Clason··You?

George S Clason's military discipline and entrepreneurial ventures shaped his approach to financial education, inspiring this classic collection of Babylonian parables. Within its pages, you explore fundamental principles like saving a portion of your income, controlling expenditures, and investing wisely, illustrated through memorable stories such as the five laws of gold. This book suits anyone ready to build a solid financial foundation through time-tested habits, especially those new to personal finance or seeking straightforward guidance without jargon. Its parables make complex financial ideas accessible, though readers looking for modern investment tactics may find it less directly applicable.

by TailoredRead AI·

This tailored book explores the multifaceted world of wealth building through a lens focused uniquely on your background and aspirations. It examines core principles such as asset growth, financial mindset, investment approaches, and risk management, all while tailoring content to match your specific interests and goals. By synthesizing vast financial knowledge into a personalized journey, it reveals pathways suited to your experience level and ambitions. This personalized approach ensures you engage deeply with concepts that matter most to you, from foundational money management to advanced wealth preservation techniques. Whether you seek to cultivate long-term financial security or accelerate growth, this book covers the terrain with clarity and enthusiasm, making complex ideas accessible and relevant.

Recommended by Lynnette Khalfani-Cox

The Money Coach, NYT bestselling author

“The Black Girl's Guide to Financial Freedom is a great roadmap to mastering your money - and learning a lot about yourself in the process. With practical advice and a solid dose of big sister wisdom, Paris Woods shows you how to check your financial assumptions, reframe unhealthy attitudes about money, and figure out the best path for your unique financial journey.” (from Amazon)

by Paris Woods··You?

Paris Woods, with her extensive background in education and personal finance, crafted this guide to demystify wealth-building for Black women, drawing from years of both personal trial and professional expertise. The book walks you through practical approaches to generate generational wealth, avoid common financial pitfalls, and achieve financial independence without relying on traditional paths like real estate or entrepreneurship. Specific chapters focus on earning degrees debt-free and designing a retire-early lifestyle tailored to your dreams, making complex financial concepts accessible and relatable. It's especially suited for those seeking a fresh, straightforward perspective on money management that fits diverse career stages and life goals.

Recommended by Kenny Accent Investing

Finance educator and wealth strategist

“Powerful Lessons From the Book Rich Dad, Poor Dad That Will Make Your Finances Better Than 99% of People:” (from X)

by Robert T. Kiyosaki··You?

by Robert T. Kiyosaki··You?

Unlike most wealth books that focus on basic saving and investing, Robert Kiyosaki challenges you to rethink how money works through the lens of his CASHFLOW Quadrant framework. You'll learn to distinguish between employee, self-employed, business owner, and investor roles, understanding how each impacts your financial freedom and tax liabilities. The book dives into shifting your mindset from working for money to having money work for you, with chapters dedicated to tax strategies and investment principles that the rich use. If you're ready to question conventional financial advice and explore paths to generating passive income, this book lays out a clear, if sometimes provocative, roadmap.

Recommended by John Crestani

Entrepreneur and educator

“@evantindell The book 'The Millionaire Fastlane' by MJ Demarco went very indepth into the economics of the pre-smartphone limousine drivers business and was fascinating.” (from X)

MJ DeMarco challenges the conventional wisdom that a slow, frugal path leads to wealth, arguing instead for a fastlane approach to financial freedom. Drawing from his experience building multi-million dollar transportation startups, he exposes why traditional advice like relying on jobs, 401(k)s, and indexed funds often traps people in mediocrity. You’ll learn the economic principles behind wealth creation, how leverage accelerates financial gain, and why passion alone isn’t enough to get rich. This book suits those ready to break free from standard financial norms and seek a more dynamic, entrepreneurial route to lasting wealth.

This tailored book explores focused actions designed to boost your wealth within a 90-day timeframe. It examines practical financial concepts and personalized pathways that match your background and goals, ensuring the content aligns closely with your unique financial situation. By presenting a clear, step-by-step plan, the book guides you through actionable steps to accelerate your financial growth rapidly while addressing the complexity of wealth-building in a digestible manner. The content delves into income generation, investment choices, and expense management, all tailored to focus on your interests and empower swift progress. This personalized approach reveals how to harness your resources efficiently for noticeable results in a short span.

Recommended by Noah Kagan

Founder of AppSumo, early Facebook and Mint employee

“@SonyaLooney I LOVE this book. CC @morganhousel” (from X)

Morgan Housel, an award-winning financial writer, explores the unpredictable ways people think about money beyond formulas and spreadsheets. This book breaks down 19 vivid stories that reveal how your personal history, ego, and emotions shape financial choices. You'll gain insights into patience, risk, and the subtle behaviors driving wealth accumulation, such as understanding why saving consistently outperforms chasing hot tips. Whether you're a seasoned investor or just starting to manage your finances, Housel's perspective helps you rethink money as a deeply human experience, not just numbers on a page.

Recommended by Angela Yee

Host of The Breakfast Club, media entrepreneur

“The lessons that Cedric teaches about creating wealth should be required reading in school. I didn't develop a millionaire mindset until my thirties, but having this mentorship and learning these actionable steps would have accelerated my road to prosperity. So many of us don't have the startup capital or access to funds, but where you start doesn't have to be where you finish!” (from Amazon)

by Cedric Nash··You?

Cedric Nash draws from his extensive experience as an investor and CEO to challenge why wealth feels out of reach for many, especially minorities. His M$M wealth-building system combines mindset shifts, core values, and financial moves, guiding you from wherever you start to millionaire status. Through engaging stories and practical examples—like investing in real estate and entrepreneurship—he breaks down complex financial strategies into accessible steps. If you want a frank conversation about closing racial wealth gaps while building lasting income, this book offers a grounded roadmap. It's best suited for those ready to rethink money habits and take control of their financial future.

Recommended by Daymond John

Founder & CEO of FUBU, Shark Tank Investor

“Big Money Energy is the ultimate primer for success. Ryan Serhant shows readers how to exude positive energy, own a room and make their biggest dreams a reality.” (from Amazon)

When Ryan Serhant realized that changing his energy was the key to transforming his life, he crafted Big Money Energy to share that insight. This book teaches you how to exude confidence and harness a mindset that shifts your financial trajectory and personal power. By exploring specific strategies such as developing unstoppable commitment and projecting authentic self-assurance, Serhant guides you through reshaping your approach to money and success. Whether you're climbing the corporate ladder or building your own venture, you'll find practical examples like his journey from paycheck-to-paycheck to a billion-dollar broker. If you seek motivation paired with a mindset overhaul rather than quick fixes, this book fits your ambition.

Recommended by Fiona The Millennial Money Woman

Financial strategist and millionaire mentor

“@DecadeInvestor Index funds are one of the best way to build wealth over the long term. Great book and great read!” (from X)

by Jl Collins, MR Money Mustache··You?

by Jl Collins, MR Money Mustache··You?

When J L Collins realized that most investment advice overcomplicates what should be straightforward, he wrote this guide to demystify financial independence. You learn how to avoid debt, understand the stock market’s real behavior, and implement a simple investing strategy focused on low-cost index funds. The book breaks down concepts like asset allocation, retirement accounts, and the 4% safe withdrawal rule, making them accessible regardless of your experience. If you want a no-frills roadmap to building and preserving wealth without getting lost in jargon, this book provides clear, practical insights tailored for everyday investors.

Recommended by Manny Fernandez

Investor and keynote speaker, co-founder RealtyReturns

““Nothing great was ever accomplished without inspiration.” Here is a great free audio book. Think and Grow Rich” (from X)

by Napoleon Hill··You?

Napoleon Hill challenges the conventional wisdom that wealth is solely about money by exploring the mindset and principles behind lasting success. Drawing from decades of research and stories of iconic figures like Andrew Carnegie and Henry Ford, you learn specific techniques to harness desire, faith, and persistence as tools for financial and personal achievement. The book teaches not just what to do but how to cultivate the mental attitudes and habits that underpin true wealth, including chapters on mastering fear and building focused plans. If you're seeking guidance on transforming ambition into tangible results through mindset shifts, this book offers a well-rooted philosophy that benefits entrepreneurs and self-motivated individuals alike.

Recommended by Joe Sanberg

Entrepreneur; Co-Founder @Aspiration; Social Justice Advocate

“I am so proud of my fiancée Nicole Lapin who just received great news that her new book, Miss Independent, is #2 on the Wall Street Journal Best Seller list. Nicole is authentically passionate about and dedicated to empowering all women through understandable financial advice!” (from X)

by Nicole Lapin··You?

Nicole Lapin challenges the conventional wisdom that investing is complicated and inaccessible, especially for women. Drawing on her extensive experience as a financial journalist and TV anchor, she breaks down investing basics, from stocks and bonds to more complex assets like REITs and cryptocurrency, in straightforward, relatable terms. You’ll learn how to automate savings, understand key financial terms, and make empowered decisions about mortgages and insurance, all framed around a clear 12-step plan to grow wealth. This book suits anyone ready to move beyond budgeting toward financial independence with practical, no-frills guidance.

Recommended by New York Magazine

“A cheerful manifesto on removing obstacles between yourself and the income of your dreams.” (from Amazon)

by Jen Sincero··You?

Jen Sincero draws on her personal turnaround from financial struggle to business success to tackle the mindset barriers that keep you from wealth. You’ll find a mix of humorous essays and concise mindset exercises aimed at reshaping your relationship with money, such as recognizing limiting beliefs and reframing doubts that hold you back. The book shares practical strategies to shift your thinking, from embracing your earning potential to actively shaping your financial reality. If you want to understand how your mental blocks affect your financial outcomes and learn ways to overcome them, this book speaks directly to you, though it’s less about technical finance skills and more about psychological shifts.

by Ramit Sethi··You?

Drawing from his background in technology and psychology at Stanford, Ramit Sethi delivers a straightforward program that reshapes how you handle money. Through a no-nonsense six-week plan, you learn to automate savings, set up smart bank accounts, and negotiate financial challenges like debt and big purchases with confidence. The book’s blend of practical scripts and behavioral insights equips you to spend guilt-free while steadily building wealth. If you want a method that balances disciplined money management with the freedom to enjoy your lifestyle, this book lays out exactly how to do it.

Recommended by James O'Shaughnessy

Founder and Chairman, OSAM LLC

“Nick has a genuine gift - while he uses rigorous empirical evidence to make his case, he also manages to tell the story in such a way to keep the reader's attention and give them practical, actionable advice. In addition, he has just enough of a mischievous streak to challenge some long-held assumptions about investing, but in a manner that makes the empirical data a fresh, interesting story. Investors, new and old, will benefit from Nick's practical approach to investing.” (from Amazon)

by Nick Maggiulli··You?

by Nick Maggiulli··You?

Nick Maggiulli challenges common investing beliefs by grounding his advice in data rather than speculation. Drawing from his role as COO and data scientist at Ritholtz Wealth Management, he examines topics like why saving less than you think can still build wealth and why timing market dips isn't as effective as it seems. You’ll gain insight into managing your finances with evidence-backed strategies, including how to navigate market crashes and optimize your saving habits. This book suits anyone looking to strengthen their money management skills with a practical, numbers-driven approach rather than relying on conventional financial advice.

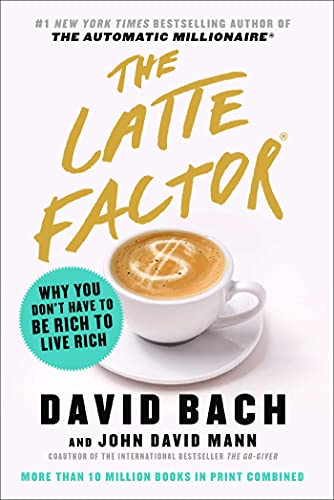

Recommended by Tony Robbins

Business and life coach, motivational speaker, author

“David Bach is the one financial expert to listen to when you’re intimidated by your finances. His powerful and easy-to-use program will show you how to spend, save and invest your money to afford your dreams.” (from Amazon)

by David Bach, John David Mann··You?

by David Bach, John David Mann··You?

What if everything you knew about building wealth was wrong? David Bach, a trusted financial expert with a track record of New York Times bestsellers, argues that financial freedom isn’t about earning more but making smarter choices daily. Through the story of Zoey, a young professional drowning in debt, Bach and coauthor John David Mann reveal how small, consistent changes—like skipping daily luxuries—can accumulate into significant savings. You’ll learn to identify and redirect unnecessary expenses toward your dreams, with concepts like the “Three Secrets to Financial Freedom” that simplify complex money management. This book suits anyone feeling overwhelmed by personal finance and seeking a straightforward path to financial confidence.

Recommended by Grant Sabatier

Author and creator of Millennial Money

“Quit Like A Millionaire is about so much more than making money, traveling the world, and retiring early (although it teaches you how to do all three insanely well!). It’s a new roadmap to living an awesome life! You don't need to settle for status quo. Life's too short for that; so don't. This book will both inspire and entertain you, while actually giving you the steps and mindset to become a millionaire. Retiring early isn't easy, but it's never been easier in history to make it happen. There’s no fluff here. This is the real deal.” (from Amazon)

by Kristy Shen, Bryce Leung, JL Collins··You?

by Kristy Shen, Bryce Leung, JL Collins··You?

What started as Kristy Shen's challenging journey from living on just 44 cents a day to retiring as a millionaire at 31 became a practical guide for anyone seeking financial independence without relying on luck or entrepreneurship. The book breaks down the math behind building a million-dollar portfolio, managing investments through bear markets, and applying the 4 percent rule alongside the Yield Shield to safeguard your wealth. You’ll learn how to cut expenses without sacrificing quality of life and how to navigate retirement planning with clarity and confidence. This approach benefits anyone aiming to retire early or gain control over their finances through proven, reproducible strategies rather than risky bets.

Recommended by Karen Hunter

Pulitzer-winning journalist and publisher

“@Kadirakali @kdaniels1023 I like The Automatic Millionaire and Smart Women Finish Rich by @DavidBachBooks #DavidBach. @TheBudgetnista has an amazing book that will give her the basics as she builds her knowledge...#GetGoodwithMoney:” (from X)

by David Bach··You?

Unlike most wealth books that focus heavily on complex budgeting or investment jargon, David Bach’s approach centers on simplicity and automation to build lasting financial security. Drawing from his extensive experience as a former Morgan Stanley senior vice president and bestselling author, Bach walks you through setting up an automatic system that steadily grows your savings without requiring constant oversight. You’ll gain practical insights into tax-efficient investing, using technology to streamline finances, and the psychological benefits of automating money management, as laid out in chapters detailing updated apps and strategies. This method suits anyone looking to reduce financial stress through consistent habits rather than intense budgeting, although those seeking in-depth investment tactics might find it less exhaustive.

Recommended by BookAuthority

“One of the best Wealth books of all time” (from Amazon)

by Linda P. Jones··You?

Linda P. Jones draws on her personal journey to $2 million by age 39 and her top-ranked podcast experience to challenge typical wealth-building advice. Instead of promoting austerity or relentless work, she offers a clear framework called the Millionaire Action Plan (MAP)™, teaching you how to prioritize spending, recognize financial cycles, and harness compounding effectively. You’ll find concrete tools like the Wealth Heiress Checklist that guide you step-by-step toward financial freedom, tailored for women across generations who want to rethink wealth on their terms. If you’re tired of one-size-fits-all money advice, this book offers a fresh perspective grounded in real results and practical mindset shifts.

Recommended by Richard Bernstein

CEO and Chief Investment Officer, Richard Bernstein Advisors

“I have known Raj Sharma for nearly thirty years, and during that time I’ve come to know him as one of the most thoughtful and most sincere financial advisors in the business.” (from Amazon)

by Raj Sharma··You?

While working as a top financial advisor for over thirty years, Raj Sharma noticed significant gaps in wealth management, especially the lack of diversity and support for emerging professionals. His book guides you through building a rewarding advisory career by focusing on client-centered values and entrepreneurial spirit. You’ll learn how to navigate industry barriers, cultivate a diverse client base, and secure your own financial future, with chapters addressing practical strategies for client engagement and business ownership. This book is especially helpful if you’re an aspiring advisor eager to grow sustainably and ethically in a complex market.

by Michael Zhuang··You?

Michael Zhuang's decades of experience in quantitative finance and wealth advisory shine through in this guide tailored for entrepreneurs. You learn how managing personal wealth differs fundamentally from running a business, with chapters dedicated to investing wisely, mitigating taxes, choosing the right financial advisor, and planning a strategic business exit. Zhuang addresses the unique challenges entrepreneurs face, including balancing personal well-being while scaling a business, and offers a roadmap to transitioning into a work-optional lifestyle. This book benefits business owners who want to secure long-term financial stability beyond their company’s success, avoiding common pitfalls of poor personal financial planning.

Get Your Personal Wealth Strategy in 10 Minutes ✨

Stop following generic advice. Get tailored wealth strategies that fit your unique situation without reading dozens of books.

Trusted by 85+ expert recommenders in Wealth

Conclusion

This collection reveals three clear themes: the power of mindset, the importance of practical strategies, and the value of tailored approaches. If you're just starting to explore wealth-building, books like The Simple Path to Wealth and Miss Independent provide accessible foundations. For rapid implementation, pairing The Millionaire Fastlane with Rich Dads CASHFLOW Quadrant can accelerate your entrepreneurial journey.

For those looking to deepen psychological understanding, The Psychology of Money and You Are a Badass at Making Money offer insightful perspectives on behavior and mindset shifts. Alternatively, you can create a personalized Wealth book to bridge general principles with your specific situation.

These books can help you accelerate your learning journey and empower you to take control of your financial future with confidence and clarity.

Frequently Asked Questions

I'm overwhelmed by choice – which book should I start with?

Start with Rich Dad Poor Dad for foundational mindset shifts or The Simple Path to Wealth for practical investing basics. These lay a solid groundwork before exploring more specialized titles.

Are these books too advanced for someone new to Wealth?

Not at all. Many, like Miss Independent and The Black Girl's Guide to Financial Freedom, are designed for beginners with clear, accessible advice to build confidence from the ground up.

What’s the best order to read these books?

Begin with mindset and personal finance basics (Rich Dad Poor Dad, The Psychology of Money), then move to investing and entrepreneurship (The Millionaire Fastlane, Rich Dads CASHFLOW Quadrant), and finish with specialized guides.

Should I start with the newest book or a classic?

Classics like Think and Grow Rich provide timeless mindset lessons, while newer books like Big Money Energy offer fresh perspectives. Balancing both gives a well-rounded view.

Can I skip around or do I need to read them cover to cover?

You can skip around based on your interests. Each book stands alone with valuable insights, so pick topics that resonate with your current financial goals.

How can I apply these books’ insights to my unique financial situation?

These expert books offer valuable frameworks, but personalized content can bridge general advice with your specific needs. Consider creating a tailored Wealth book to get targeted strategies that fit your background and goals.

📚 Love this book list?

Help fellow book lovers discover great books, share this curated list with others!

Related Articles You May Like

Explore more curated book recommendations